RegTech

Anti-money laundering (AML) procedures contribute to the security of financial institutions. Preventing money laundering and stopping criminals from engaging in transactions to disguise the origins of funds connected to illegal activity.

Multiple factors are involved to ensure the authenticity and security of customers and businesses. Such as white-label KYC & KYB software, PEPs and Sanctions, and Fraud Monitoring. You can find all results neatly organised in our virtual scoring & rating system.

KYC

powered by FinCheck

The white-label KYC software that SEPA Cyber Group provides allows businesses to identify and verify individuals—authenticating users through Address, ID and Passport Verification. Our KYC software helps prevent identity theft, money laundering, financial fraud, terrorism financing, and other financial crimes. Its built-in AI detects and authenticates all security features on identity documents.

KYB

powered by FinCheck

KYB outlines the process a financial institution must go through to verify the legitimacy of a corporate client and increase annual returns. UBO, Tax Data & Company Verification are partly done by validating business owners’ identities. Our KYB software prevents organisations from dealing with corrupt businesses and money launderers.

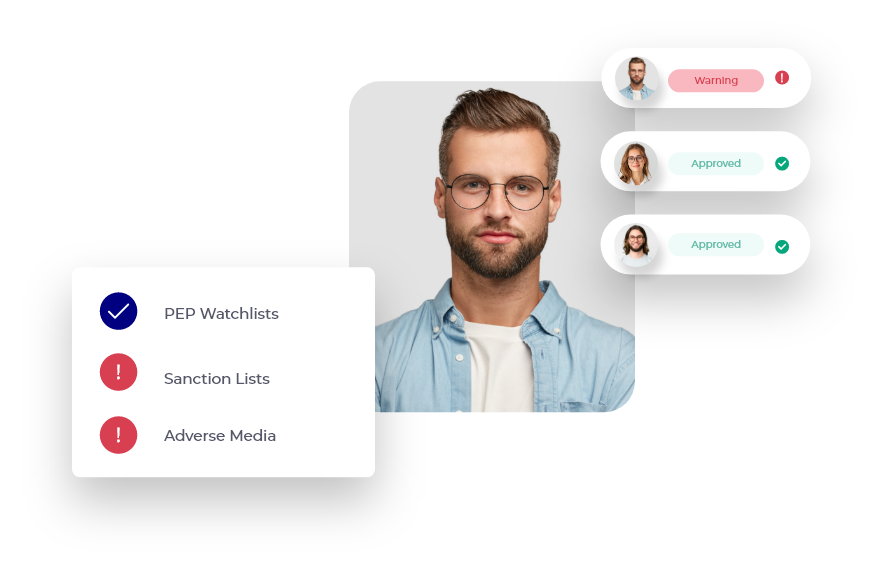

PEPs and Sanctions

powered by FinCheck

The PEPs & Sanction software of SEPA Cyber Group facilitates and streamlines the onboarding of new customers. Our solution allows screening in different global watchlists such as OFAC, HTM, EU, UN, etc. Once the data is collected, our system will automatically execute a search in international and local PEP, Sanction, & EDD lists.

Fraud Screening

powered by FinCheck

Our FS software allows companies to pinpoint fraudulent activities without compromising their operations. The solution enables following all international AML regulations with our Traffic Analytics CNP & Fraud Monitoring System. It screens user activities 24/7 and provides results in 95% fraud detection and protection against cyberattacks.

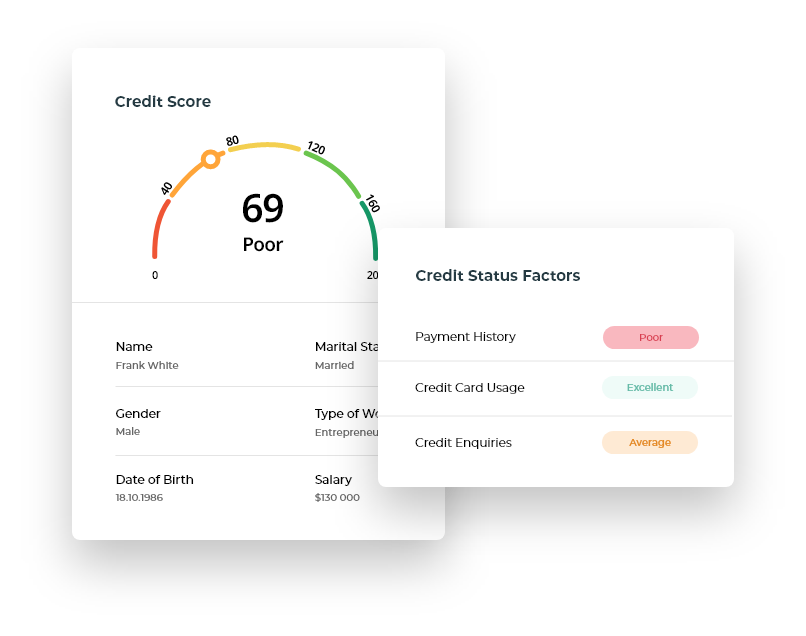

Virtual Scoring and Rating System

powered by FinCheck

The Virtual Scoring solution of SEPA Cyber Group automates procedures and allows actionable data gathering with reliable credit risk rating software. Reducing the time and resources that organisations use to manage their operations.

The scoring and rating engine enables businesses to estimate borrowers’ payment behaviour and make more profitable decisions. Specifically designed to monitor user activities and generate reports. Allowing companies to evaluate the behaviour of their customers and partners.