Global Payments with Our connect modules

SEPA Cyber Group is always working on providing top-of-the-line payment solutions to small and large businesses. Our Connect modules are developed per UNIFI (ISO 20022) requirements.

SEPA

powered by FinTraNs

The Single Euro Payments Area (SEPA) is a payment network that facilitates bank transfers in the Eurozone, European Union, and other affiliates countries such as Switzerland, Norway, Monaco, San Marino, the United Kingdom, etc.

SWIFT

powered by FinTraNs

SWIFT is a protocol that ensures and facilitates financial transactions and payments between banking institutions worldwide. It’s one of the main components of the global payment system.

Faster Payments

powered by FinTraNs

Faster Payments System (FPS) is used in the United Kingdom to reduce payment times between banks’ customer accounts. Unlike CHAPS, FPS focuses on smaller payments of up to £1 million. It reduces transaction time from days to seconds.

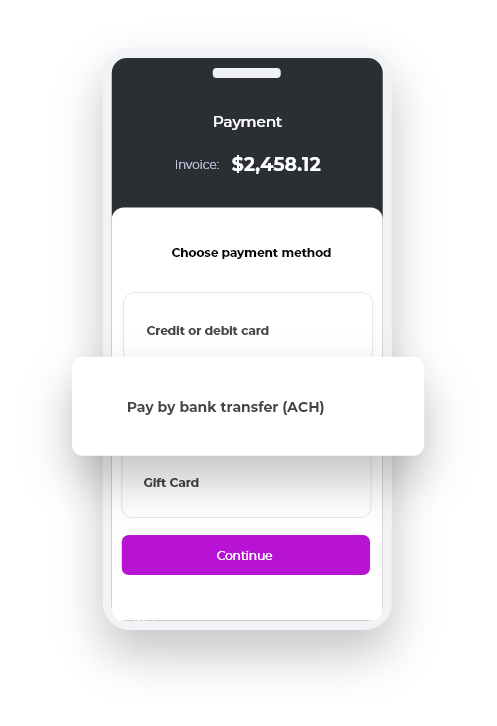

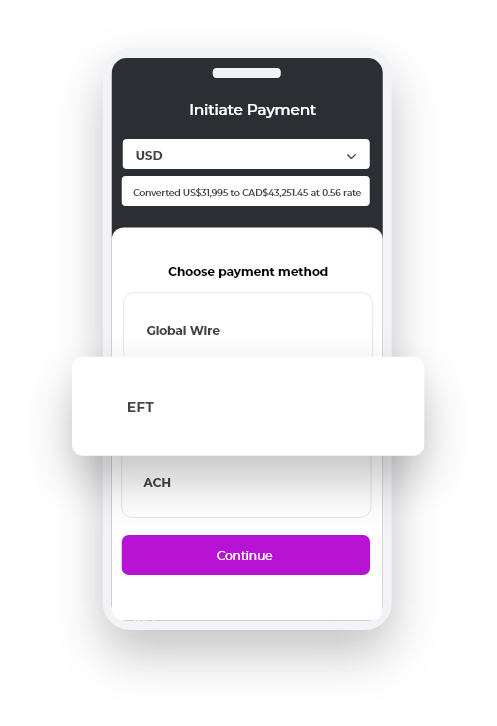

ACH

powered by FinTraNs

The United States uses the ACH Network to process electronic funds transfers. It executes transactions from individuals and businesses, as well as local, state, and federal governments. It handles large volumes of debit and credit operations.

EFT

powered by FinTraNs

The EFT System offers real-time transactions and real-time gross settlement of Turkish Lira intrabank payments. CBRT developed the network, and its third generation (which functions today) was launched in 2013.

CBDP

powered by FinTraNs

Cross-border digital payments for the APAC region include multiple banks. They often transfer funds in Yuan from one country to another, attracting significant bank fees at each payment gateway. Also, exchange rates between different currencies and local taxes for each country are big considerations.

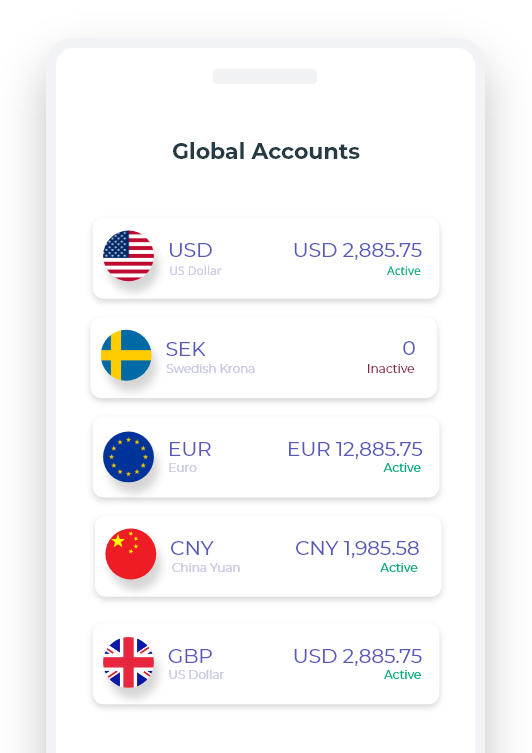

Next-Gen International Payments Technology

Integrating our Connect modules allows companies to execute secure regional and cross-border transactions within and outside the network. Each option has different features, like various execution protocols, verification directives, encryption algorithms, etc. They can also be updated with future functionalities issues by their respective authorities. Our Connect modules are easy to deploy into existing systems. They support online transfers, mobile app payments, and digital wallets.