Embedded Finance

Business

Bank Accounts

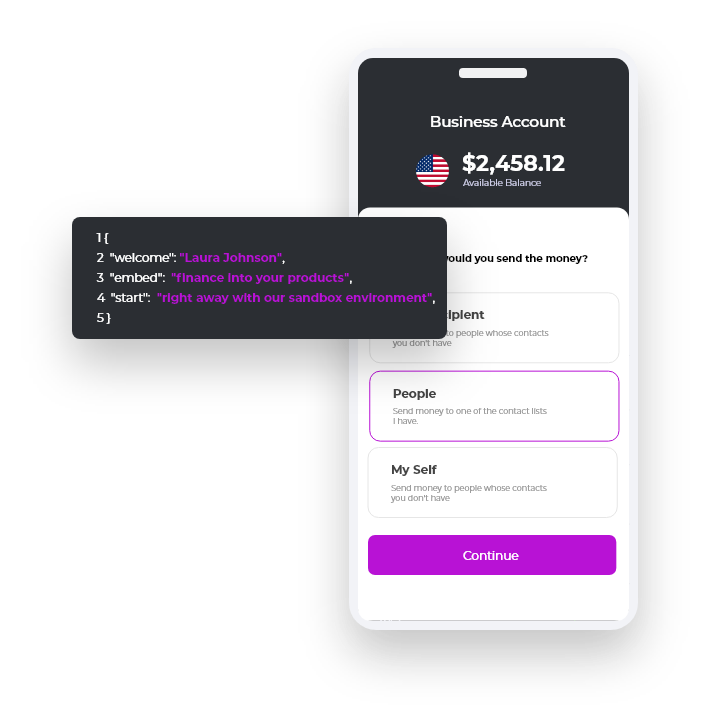

Offer clients the ability to open business bank accounts directly through your platform by using our embedded finance services. Our easy-to-deploy, API-based products can convert your existing framework from a non-financial system into a comprehensive banking platform.

Incoming and

Outgoing Payments

Implementing embedded finance into your system will allow users to conduct inbound and outbound transactions. Our solutions make it easier for clients to execute payments and receive money as their financial and non-financial tools are in the same place.

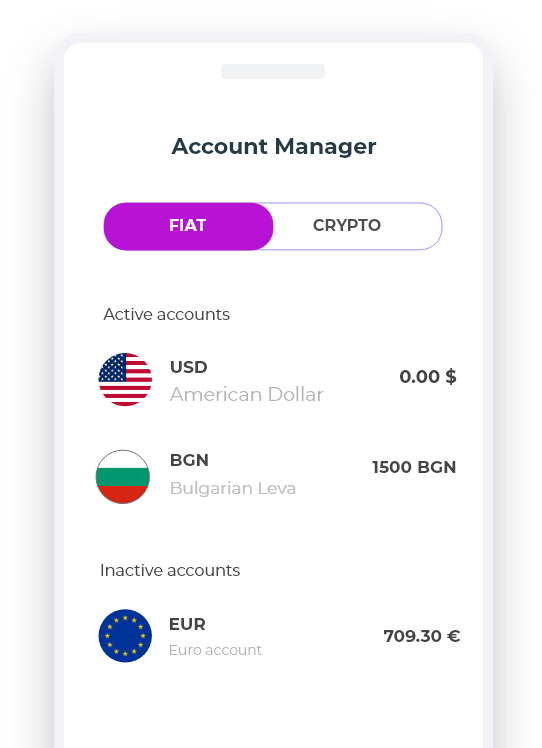

Multi-Currency

Account Management

FinHub’s embedded finance service includes multi-currency account management. Users can make and receive money transfers in different currencies. Our product is compatible with varying payment networks, including SEPA, SWIFT, Faster Payments, and ACH.

White-Label

Debit Card Issuance

Improve client retention and engagement by issuing debit cards with your brand. We can help with the issuance of PVC, eco, and hybrid cards made from different materials, including precious metals and gemstones.

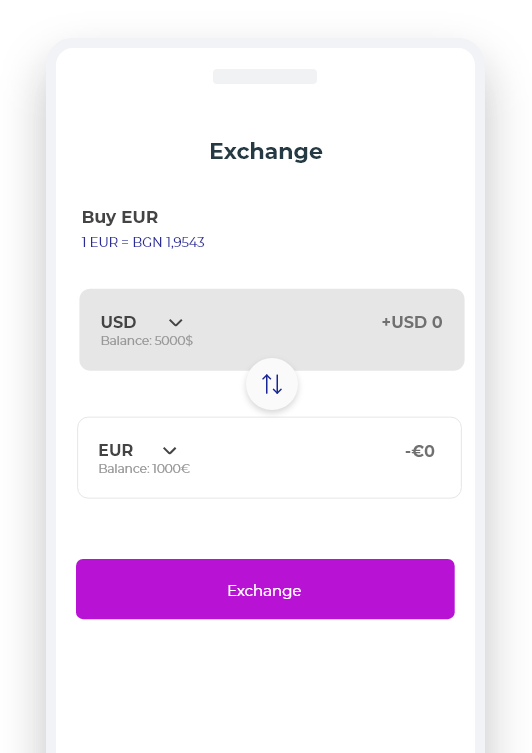

Crypto Transactions

and Exchange

Cryptocurrencies are becoming more and more popular every day. With FinHub, non-banked organisations can offer their customers the option to exchange fiat currency for crypto and vice versa. Our platform can also execute incoming and outgoing transactions with cryptocurrency.

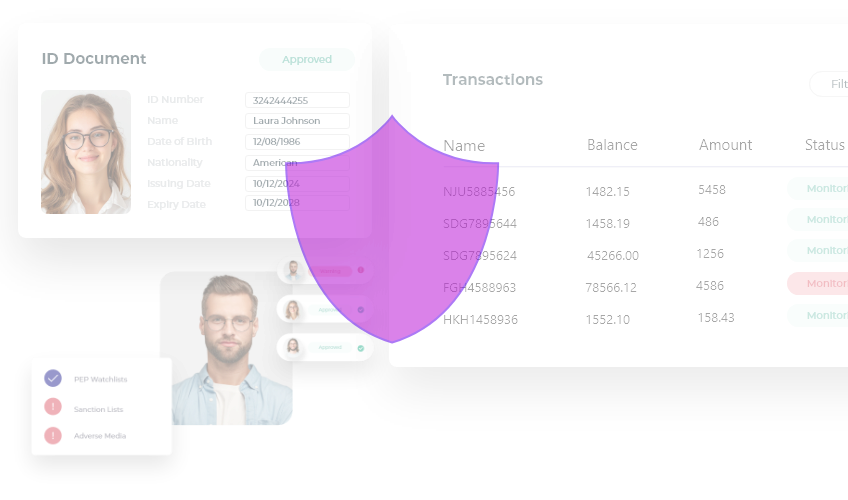

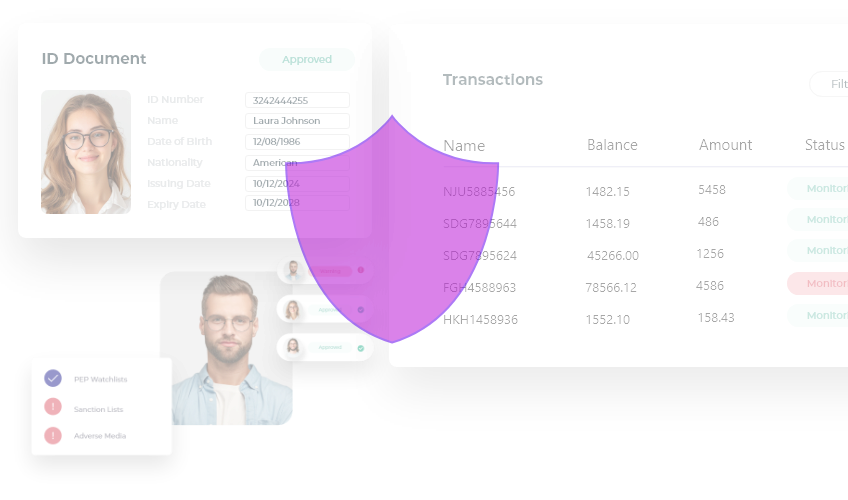

Full Compliance

Our embedded finance services are developed to comply entirely with Anti-Money Laundering (AML) regulations. Once integrated, our products allow our clients to deploy Know Your Customer (KYC), Know Your Business (KYC), and Politically Exposed Persons (PEPs) & Sanctions, and transaction monitor protocols to manage risks in real-time effectively.